Annex II [with effect until ]: Article 51 of this Regulation [1]

Explanatory notes

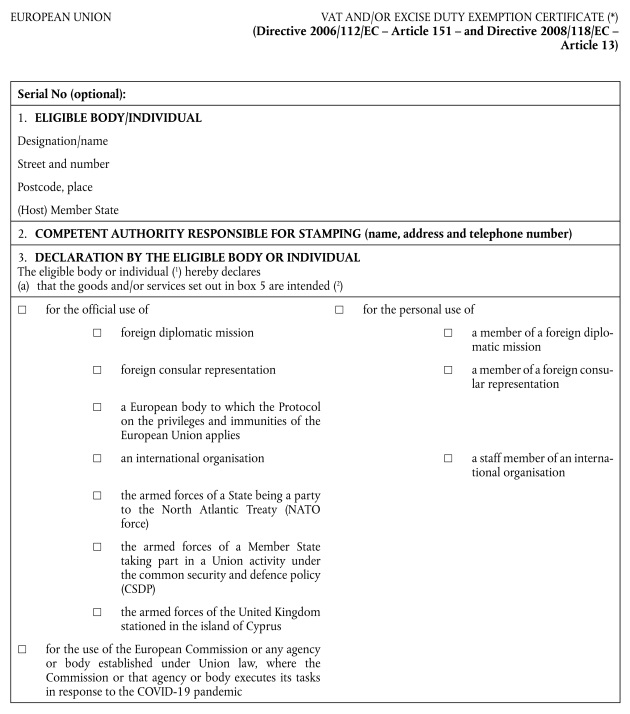

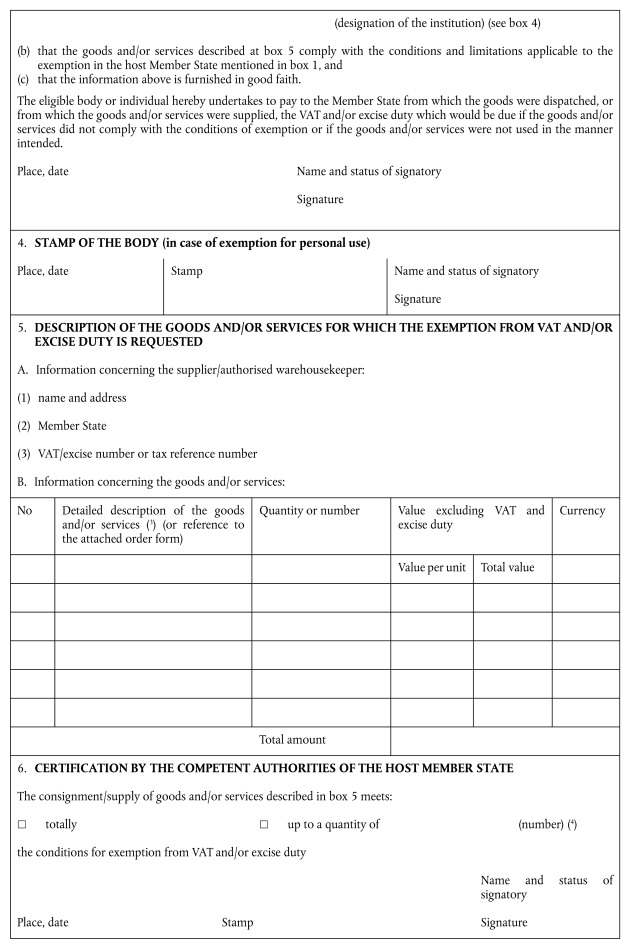

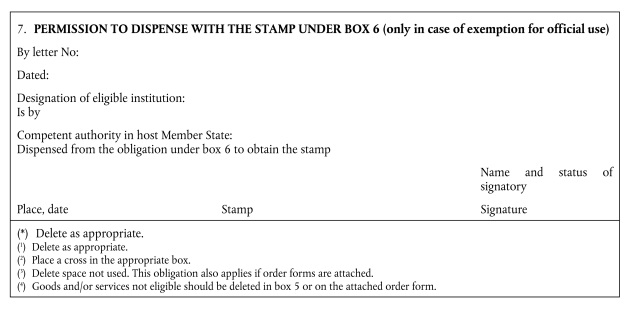

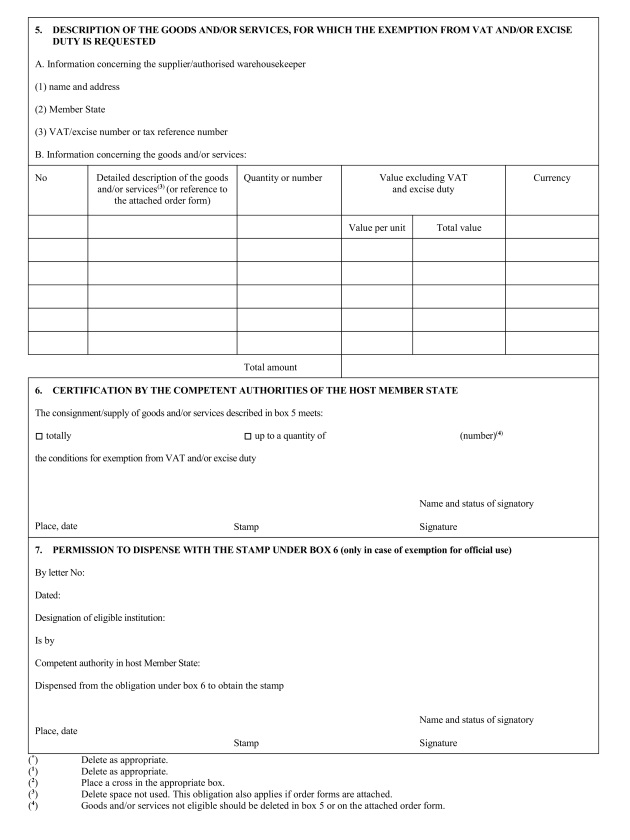

For the supplier and/or the authorised warehousekeeper, this certificate serves as a supporting document for the tax exemption of the supplies of goods and services or the consignments of goods to the eligible bodies/individuals referred to in Article 151 of Directive 2006/112/EC and Article 13 of Directive 2008/118/EC. Accordingly, one certificate shall be drawn up for each supplier/warehousekeeper. Moreover, the supplier/warehousekeeper is required to keep this certificate as part of his records in accordance with the legal provisions applicable in his Member State.

-

The general specification of the paper to be used is as laid down in the Official Journal of the European Communities (C 164, , p. 3).

The paper is to be white for all copies and should be 210 millimetres by 297 millimetres with а maximum tolerance of 5 millimetres less or 8 millimetres more with regard to their length.

For an exemption from excise duty the exemption certificate shall be drawn up in duplicate:

one copy to be kept by the consignor;

one copy to accompany the movement of the products subject to excise duty.

Any unused space in box 5.B is to be crossed out so that nothing can be added.

The document must be completed legibly and in a manner that makes entries indelible. No erasures or overwriting are permitted. It shall be completed in a language recognised by the host Member State.

If the description of the goods and/or services (box 5.B of the certificate) refers to a purchase order form drawn up in a language other than a language recognised by the host Member State, a translation must be attached by the eligible body/individual.

On the other hand, if the certificate is drawn up in a language other than a language recognised by the Member State of the supplier/warehousekeeper, a translation of the information concerning the goods and services in box 5.B must be attached by the eligible body/individual.

A recognised language means one of the languages officially in use in the Member State or any other official language of the Union which the Member State declares can be used for this purpose.

By its declaration in box 3 of the certificate, the eligible body/individual provides the information necessary for the evaluation of the request for exemption in the host Member State.

By its declaration in box 4 of the certificate, the body confirms the details in boxes 1 and 3(a) of the document and certifies that the eligible individual is a staff member of the body.

-

The reference to the purchase order form (box 5.B of the certificate) must contain at least the date and order number. The order form should contain all the elements that figure at box 5 of the certificate. If the certificate has to be stamped by the competent authority of the host Member State, the order form shall also be stamped.

The indication of the excise number defined in Article 2, point (12), of Council Regulation (EU) No 389/2012 of 2 May 2012 on administrative cooperation in the field of excise duties and repealing Regulation (EC) No 2073/2004 is optional; the VAT identification number or tax reference number must be indicated.

The currencies should be indicated by means of a three-letter code in conformity with the ISO code 4217 standard established by the International Standards Organisation [2].

The abovementioned declaration by the eligible body/individual shall be authenticated at box 6 by the stamp of the competent authority of the host Member State. That authority can make its approval dependent on the agreement of another authority in its Member State. It is up to the competent tax authority to obtain such an agreement.

To simplify the procedure, the competent authority can dispense with the obligation on the eligible body to ask for the stamp in the case of exemption for official use. The eligible body should mention this dispensation at box 7 of the certificate.

Annex II [with effect from until ]: Vat and/or Excise Duty Exemption Certificate referred to in Article 51 [3] [4]

Explanatory notes

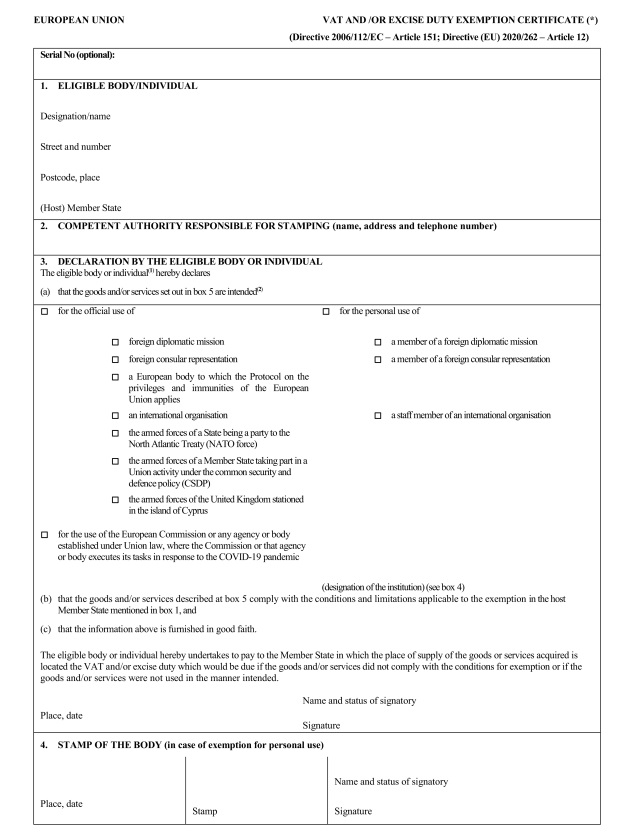

For the supplier and/or the authorised warehousekeeper, this certificate serves as a supporting document for the tax exemption of the supplies of goods and services or the consignments of goods to the eligible bodies/individuals referred to in Article 151 of Directive 2006/112/EC and Article 12 of Directive (EU) 2020/262. Accordingly, one certificate shall be drawn up for each supplier/warehouse-keeper. Moreover, the supplier/warehousekeeper is required to keep this certificate as part of his records in accordance with the legal provisions applicable in his Member State.

-

The general specification of the paper to be used is as laid down in the Official Journal of the European Communities (C 164 of , p. 3).

The paper is to be white for all copies and should be 210 millimetres by 297 millimetres with а maximum tolerance of 5 millimetres less or 8 millimetres more with regard to their length.

For an exemption from excise duty the exemption certificate shall be drawn up in duplicate:

one copy to be kept by the consignor;

one copy to accompany the movement of the products subject to excise duty.

Any unused space in box 5.B. is to be crossed out so that nothing can be added.

The document must be completed legibly and in a manner that makes entries indelible. No erasures or overwriting are permitted. It shall be completed in a language recognised by the host Member State.

If the description of the goods and/or services (box 5.B of the certificate) refers to a purchase order form drawn up in a language other than a language recognised by the host Member State, a translation must be attached by the eligible body/individual.

On the other hand, if the certificate is drawn up in a language other than a language recognised by the Member State of the supplier/warehousekeeper, a translation of the information concerning the goods and services in box 5. B must be attached by the eligible body/individual.

A recognised language means one of the languages officially in use in the Member State or any other official language of the Union which the Member State declares can be used for this purpose.

By its declaration in box 3 of the certificate, the eligible body/individual provides the information necessary for the evaluation of the request for exemption in the host Member State.

By its declaration in box 4 of the certificate, the body confirms the details in boxes 1 and 3(a) of the document and certifies that the eligible individual is a staff member of the body.

-

The reference to the purchase order form (box 5.B of the certificate) must contain at least the date and order number. The order form should contain all the elements that figure at box 5 of the certificate. If the certificate has to be stamped by the competent authority of the host Member State, the order form shall also be stamped.

The indication of the excise number defined in Article 2, point (12), of Council Regulation (EU) No 389/2012 of 2 May 2012 on administrative cooperation in the field of excise duties and repealing Regulation (EC) No 2073/2004 is optional; the VAT identification number or tax reference number must be indicated.

The currencies should be indicated by means of a three-letter code in conformity with the ISO code 4217 standard established by the International Standards Organisation [5].

The abovementioned declaration by the eligible body/individual shall be authenticated at box 6 by the stamp of the competent authority of the host Member State. That authority can make its approval dependent on the agreement of another authority in its Member State. It is up to the competent tax authority to obtain such an agreement.

To simplify the procedure, the competent authority can dispense with the obligation on the eligible body to ask for the stamp in the case of exemption for official use. The eligible body should mention this dispensation at box 7 of the certificate.

Fundstelle(n):

zur Änderungsdokumentation

KAAAE-61064

1↓M6

2As an indication, some codes relating to currencies currently used: EUR (euro), BGN (lev), CZK (Czech koruna), DKK (Danish krone), GBP (pound sterling), HUF (forint), LTL (litas), PLN (zloty), RON (Romanian leu), SEK (Swedish krona), USD (United States dollar).

3↓M7

4According to Art. 2 No 2 Council Implementing Regulation (EU) 2025/428 of 18 February 2025 (OJ L, 2025/428, ) Annex II will be deleted with effect from .

5As an indication, some codes relating to currencies currently used: EUR (euro), BGN (lev), CZK (Czech koruna), DKK (Danish krone), GBP (pound sterling), HUF (forint), LTL (litas), PLN (zloty), RON (Romanian leu), SEK (Swedish krona), USD (United States dollar).